By David Mason B.Comm, FCIP, CRM

This article illustrates the general opinions based on observing petroleum contractors from a supplier’s point of view. We’ve watched construction companies grow, downsize, sell, purchase or maintain their operations over the years. We share the observations through offering a business modeling tool for service technicians and recommendations regarding Business Planning.

On the service side of your petroleum contracting business, labour costs are one of the major operating expenses. To maximize operating performance and overall profitability, every business owner or manager must be able to measure the true cost of labour and how it relates proportionately to the labour rates billed to clients. The margin after deducting the full labour burden, must be sufficient to cover the balance of expenses such as equipment & tooling, indirect labour, administrative expenses and last but most importantly profit.

Labour

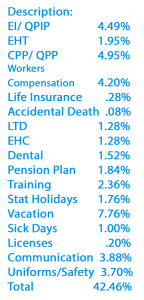

Labor costs generally refer to wages paid for mental or physical effort exerted to accomplish a task however, in business accounting, labour cost includes the cost of wages, medical insurance, life insurance, workers’ compensation insurance, pension contributions and taxes on those wages, as well as other benefits shouldered by the company. These costs are classified as direct or indirect labor. Direct labor costs are those paid to employees directly involved in the production of goods or performance of services while wages of workers not directly engaged in the production of goods or rendering services to customers, such as an office assistant, are considered indirect labor. A description of labour burdens set as a percentage for service technicians, is outlined below:

If the base labour rate is $ 25.00 per hour with the above burdens factored in, the actual cost would be $ 35.50. We encourage you to develop a schedule of labour burdens specific to your operation.

As a contractor, you constantly receive pressure from employees for raises and from customers to lower labour rates. It is recommended that the above information is shared with your employees and customers. With employees, it is quite common to include with their pay notification a total rewards statement. The statement includes a schedule of the base wage and lists all the additional labour costs paid by the employee and employer. This can hopefully provide insight and appreciation to the employee as to the actual costs of running a business.

With respect to clients, the full labour burdens as a percentage can be shared through a marketing sheet. The marketing sheet should demonstrate your company as a differentiator to those unapproved or casual contractors that move in and out of the industry. The sheet that lists the associated costs of maintaining skilled, educated and safety conscious employees can assist in justifying your labour rate. And more specifically with field technicians, the contractor can also list vehicle and equipment costs related to providing a service technician to a site.

Full labour burden vs. labour rates;

A business model template is available for download below. The model is specific to the service technician side of the business (time and material) as opposed to construction station builds. The template allows you to input various operational data to determine how labour billing rates and hourly wages impacts the bottom line. The template is set up in an excel workbook with 3 working tabs to enter information. The first tab is the income statement summary and revenue assumptions. The revenue assumptions take into account average billable hours and actual paid hours of direct labour. The remuneration tab calculates the direct and indirect labour costs. The last tab includes the equipment costs and G&A expenses. Both the remuneration and the operating tabs pull the inputs into the revenue tab which summarizes your financials by actual dollar and cost ratios to revenue. It is recommended that you start with actual data and assumptions to calibrate it to your profit margin. Then you can manipulate rates and hourly wages to determine bottom line impact. It can also be used as a planning model to determine the bottom line affect of adding direct or indirect labour. Also, the workbook does not contain any input limitation so it can be the base to customize to your company.

Note, the model is specific to the profit margin of direct and indirect labour costs with associated equipment costs and G&A expenses. The model does not factor revenue and profit associated to parts and material, billed into the service calls.

Download the article to view a sample of the calculations for a contractor with 3 service technicians: Download this article

Click on the link below to download the Rate Model Calculator (Excel file)